HM Revenue and Customs (HMRC) is reminding working parents in the North West to not miss out on the opportunity to get up to £2,000 a year to pay for regulated childcare, including holiday clubs and other out-of-school activities, during the Easter holidays.

Tax-Free Childcare provides thousands of eligible working families with up to £500 every three months (or £1,000 if their child is disabled) towards the cost of holiday clubs, before and after-school clubs, childminders and nurseries, and other approved childcare schemes.

For every £8 deposited into a Tax-Free Childcare online account, families will receive an additional £2 in government top-up, and it is available for children aged up to 11, or 17 if the child has a disability.

More than 42,870 working families used the scheme in December 2021, in the North West. Overall, HMRC paid out more than £34 million in top-up payments, which was shared between nearly 328,000 families across the UK.

With recent research estimating that around 1.3 million families could be taking up this government support, parents and carers can check their eligibility and:

register for Tax-Free Childcare via GOV.UK.

This scheme can help working families, including the self-employed, and is one of many ways the government is supporting households to reduce their costs and keep more of what they earn to help pay for other bills.

Helen Whately, HM Treasury’s Exchequer Secretary to the Treasury, said: “There are lots of brilliant holiday clubs and childcare providers to help working parents during the Easter holidays, and Tax-Free Childcare is a great offer that can help cut the childcare bills.

“I urge families across the UK to take advantage of this support and put extra pounds in their pocket - sign up now and save on your childcare costs.”

By depositing money into their accounts, families can benefit from the 20% top-up and use the money to pay for childcare costs when they need it. Accounts can be opened at any time of the year and can be used straight away.

For example, if parents and carers have school-aged children and use holiday clubs during school holidays, they could deposit money into their accounts throughout the year. This means they could spread the cost of childcare while also benefitting from the 20% government top-up. Any unused money that is deposited can be simply withdrawn at any time.

Tax-Free Childcare is also available for pre-school aged children attending nurseries, childminders, or other childcare providers. Families with younger children will often have higher childcare costs than families with older children, so the tax-free savings can really make a difference.

Childcare providers can also sign up for a:

childcare provider account via GOV.UK

...to receive payments from parents and carers via the scheme.

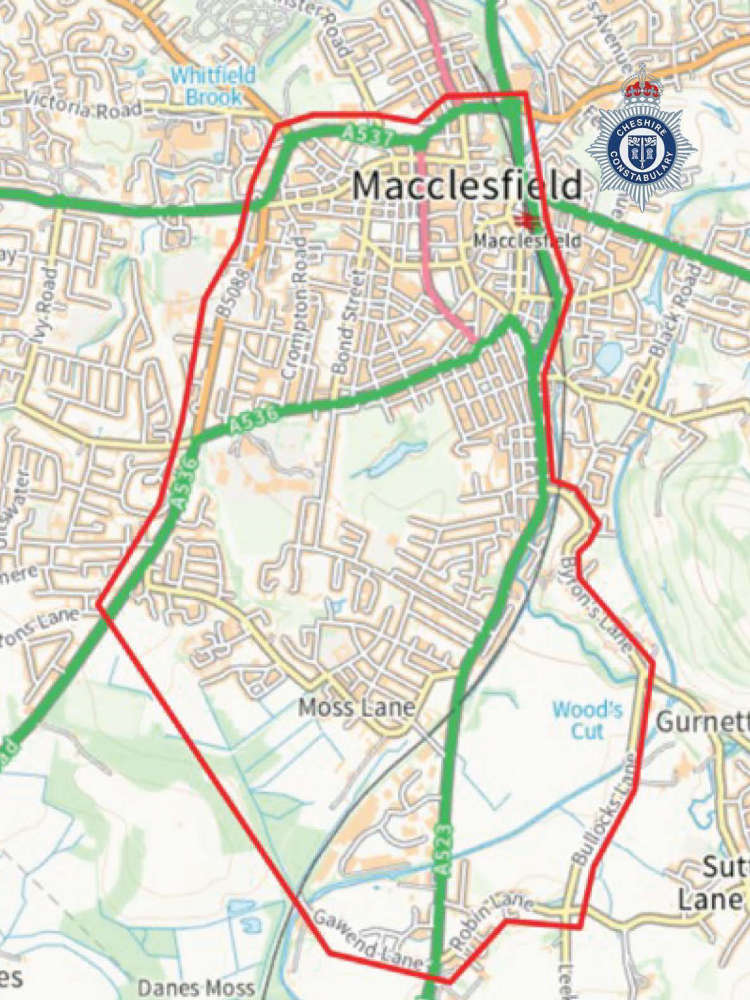

Advice for football fans in the run up to Macclesfield FC v Buxton FC match

Advice for football fans in the run up to Macclesfield FC v Buxton FC match

Two men charged in relation to Winsford rape

Two men charged in relation to Winsford rape

Appeal for information following fatal collision near Wheelock

Appeal for information following fatal collision near Wheelock

Cheshire Community Foundation launches ‘game-changing’ giving scheme

Cheshire Community Foundation launches ‘game-changing’ giving scheme

Cheshire East foster carers share festive memories in new video

Cheshire East foster carers share festive memories in new video

Cancer patient says The Christie at Macclesfield made the most frightening year of her life manageable

Cancer patient says The Christie at Macclesfield made the most frightening year of her life manageable

Cheshire National Lottery Winner Turns Santa Elf At Christmas

Cheshire National Lottery Winner Turns Santa Elf At Christmas

Have your two and three year olds flu vaccinated now

Have your two and three year olds flu vaccinated now

Man convicted of sexually assaulting a woman in Winsford

Man convicted of sexually assaulting a woman in Winsford

Warning issued following reports of a potential car meet in Alderley Edge

Warning issued following reports of a potential car meet in Alderley Edge

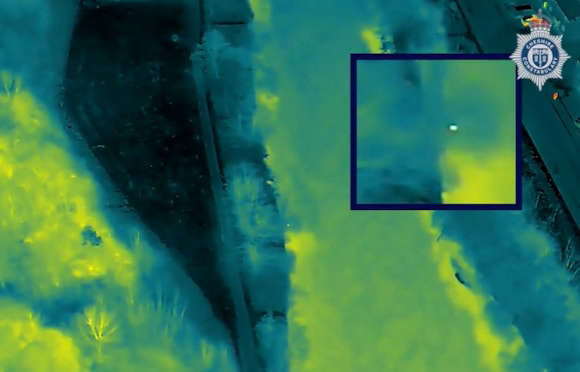

Constabulary's Drone Unit assist in rescuing man from River Weaver

Constabulary's Drone Unit assist in rescuing man from River Weaver

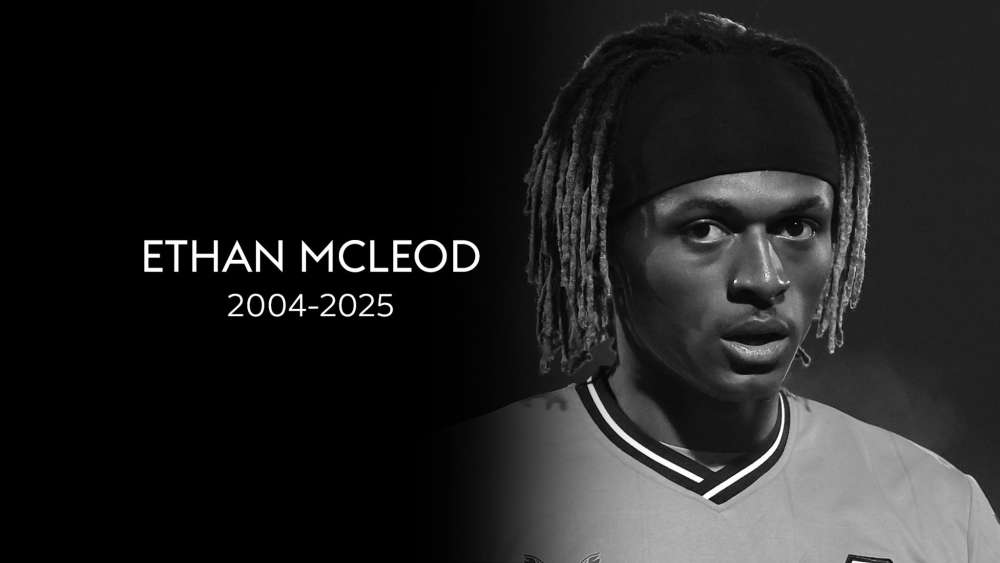

Macclesfield player Ethan McLeod passes away after car accident

Macclesfield player Ethan McLeod passes away after car accident

50,000 illegal cigarettes seized, shops closed and arrests made during immigration crime operation

50,000 illegal cigarettes seized, shops closed and arrests made during immigration crime operation

Council confirms new three-year provision to strengthen domestic abuse support

Council confirms new three-year provision to strengthen domestic abuse support

North Wales storage firm helps Crewe food bank meet soaring need

North Wales storage firm helps Crewe food bank meet soaring need

BUXTON OPERA HOUSE ANNOUNCES SLEEPING BEAUTY AS ITS 2026 PANTOMIME

BUXTON OPERA HOUSE ANNOUNCES SLEEPING BEAUTY AS ITS 2026 PANTOMIME

A message from the Cheshire Police and Crime Commissioner

A message from the Cheshire Police and Crime Commissioner

Comments

Add a comment